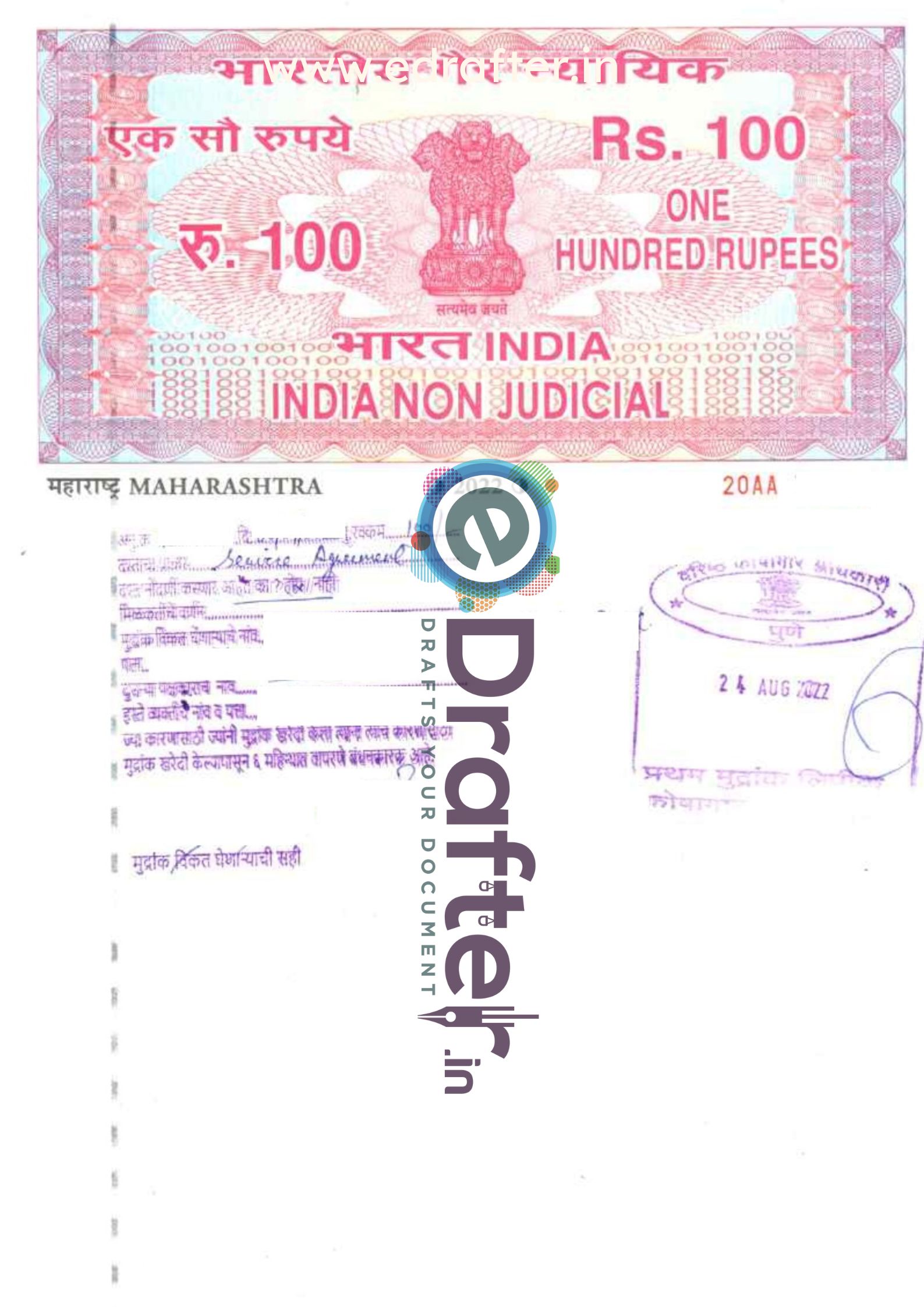

Stamp Paper of Maharashtra

महाराष्ट्राचा स्टॅम्प पेपरKnowledgebase

- Non Judicial Stamp paper and Legal Paper (Plain Paper) both are the different terms in aspect of their nature.

- On Non Judicial Stamp Paper Magistrate never write the decision of the Case, though Magistrate write the decision on the Legal Paper (Plain Paper).

- That is why it is called as Non-Judicial Stamp Paper. The Paper which not be considered as Judicial.

No, there is no e-Stamp Paper started by Maharashtra Government, there is only Non Judicial Stamp Paper in Maharashtra. Currently e-stamping is in process in 18 States.

You can get the Stamp Paper from your nearby Stamp Vendor OR easiest way to get it is through our Portal. Just Fill the above provided Form and Place an Order. After that, we will procure Stamp Papers on your behalf and will deliver it to you. “Quick & Easy”

You need to purchase in the Name of the Applicant who need to execute the Particular Stamp Paper to serve his/her purpose.

First Party means the purchaser of e-Stamp Paper. The Party who is executing e-Stamp Paper.

If there is no Second Party, then you can write NIL/Not Applicable while filling the Form and the e-stamp paper shall be generate accordingly.

In Maharashtra, there are only two denomination i.e Rs. 100 & Rs. 500 available for Stamp Paper. Hence, Rs. 100 denomination stamp paper is minimum denomination available in Maharashtra state.

Second Party can be Tenant, Vendee, Transferee, Donee etc. For ex: If you are purchasing e-Stamp Paper for Rental Agreement then in that case the First Party will be Owner and Second Party will be Tenant.

The Address field is a field provided by the Government to know the details about the Stamp Duty payer. So, its better to provide the Address of the Party OR you can also write Not Applicable in a field if you do not wish to get the Address print on e-stamp paper and e-stamp will be generated accordingly.

There are various payment mode available for citizens to pay stamp duty. They can use cash, cheque, Demand Draft, Pay Order, RTGS, NEFT and Account Transfer to pay the Stamp duty for specific transection or document.