e-Stamp Paper of Uttar Pradesh

उत्तर प्रदेश का ई-स्टाम्प पेपरLoading...

Click to Buy another State Stamp Paper

Preview of e-Stamp Paper of Uttar Pradesh

Click to place Bulk Order

Knowledgebase

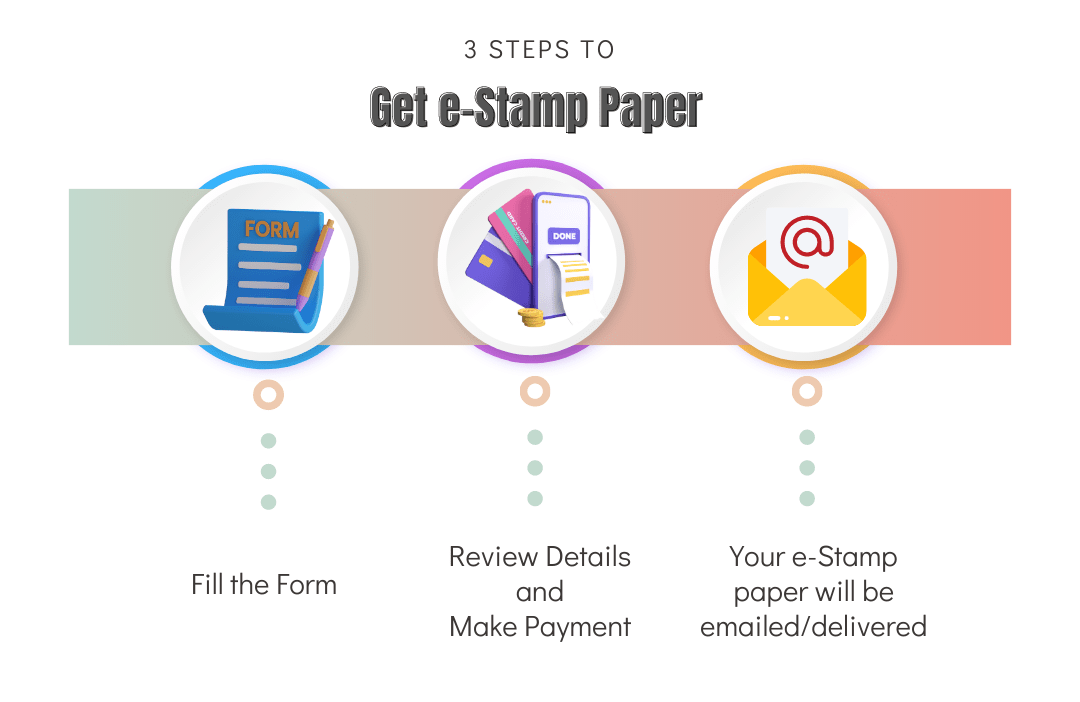

e-Stamp Paper means paying Stamp Duty to Government electronically. Currently, In there are 18 States where e-Stamp Paper available. The Karnataka State Government introduced the e-stamping system in the state in 2008. The Prevailing system of Stamp Paper has been replaced and stopped by Government and now there is only e-Stamp Paper which is more secure and reliable as compare to prevailing system of Stamp Paper.

There is no such bar in Indian Stamp Act till now that the Stamp Paper purchased in one state cannot be executed in another state.

It can be executed in another state, the Important point is that the Stamp Duty paid for a particular article should be appropriate as per state. Each State has different stamp duty for a different article. So, if you have paid appropriate Stamp Duty as per your State then the Stamp Paper purchased from one state can be executed in another State.

Yes, eStamp paper in Uttar pradesh is available and legally valid. It has been introduced by Government of Uttar Pradesh to collect the stamp duty securely and efficiently.

For physical stamp paper it is 6 months and eStamp papers are valid for lifetime in Uttar Pradesh.

No, Only authorized Banks/ACC Centers can generate e-stamp paper online. Citizens cannot generate e-Stamp Paper by there-selves. They have to approach either to the authorized Banks or to the ACC Centers of Karnataka state to get e-Stamp Paper. You can also avail e-Stamp Paper easily through our online portal.

- Open website shcilestamp.com

- After that Click on “Verify e-Stamp Certificate

- Fill the Required Details.

Details include:

- State

- Certificate Number(UIN)

- Stamp Duty Type(Description of Document)

- Certificate Issue Date

- 6 character alphanumeric string

First Party means the purchaser of e-Stamp Paper. The Party who is executing e-Stamp Paper.

If there is no Second Party, then you can write NIL/Not Applicable while filling the Form and the e-stamp paper shall be generate accordingly.

Second Party can be Tenant, Vendee, Transferee, Donee etc. For ex: If you are purchasing e-Stamp Paper for Rental Agreement then in that case the First Party will be Owner and Second Party will be Tenant.

The Address field is a field provided by the Government to know the details about the Stamp Duty payer. So, its better to provide the Address of the Party OR you can also write Not Applicable in a field if you do not wish to get the Address print on e-stamp paper and e-stamp will be generated accordingly.