Table Of Content

- What is Section 138 of the Negotiable Instruments Act?

- What is the limitation period for 138 notice?

- What Legal action can be taken against Cheque Bounce?

- Is a Legal Notice mandatory in a Cheque Bounce case?

- What are the Legal Notice Charges for Cheque Bounce?

- What is the138 Ni Act Procedure?

- How can you create a Legal Notice for Cheque Bounce?

- What are the important points to be included in the Cheque Bounce Notice?

- What are the Consequences of Cheque’s Dishonour?

- Is Section 138 is a bailable Offence?

- Legal Notice V/s Demand Notice

- Case Study

- Conclusion

Section 138 of the Negotiable Instruments Act (NI Act) deals with the dishonour of cheques due to insufficient funds, making it a criminal offence. When a cheque bounces, the payee can issue a legal notice demanding payment within 30 days of receiving notice from the bank. If the issuer fails to pay within 15 days of receiving the notice, the payee can file a criminal complaint. This provision aims to ensure timely settlement of financial obligations and deter fraudulent practices involving negotiable instruments like cheques

What is Section 138 of the Negotiable Instruments Act?

Section 13 of the Negotiable Instruments Act defines negotiable instruments as “a promissory note, bills of exchange or cheque payable either to order or to bearer”. A negotiable instrument is a kind of document that guarantees its bearer a sum of money to be payable on demand or at any future date. Section 138 of the NI Act is a penal provision that deals with the punishment of dishonour of cheque.

What is the limitation period for 138 notice?

Under Section 138 of the Negotiable Instruments Act, 1881 in India, the limitation period for issuing a notice to the drawer of a dishonoured cheque is 30 days from the date the cheque is returned unpaid due to insufficient funds or any other reason.

What Legal action can be taken against Cheque Bounce?

The time period for giving notice to the drawer under section 138 of the Negotiable Instruments Act, in case of default is thirty days from the date on which the cheque is received back unpaid from the bank. This notice requires payment within a period not exceeding fifteen days. If it is not paid within this period, then such payee may file court proceedings within 30 days after that period ends. Therefore, upon dishonouring of a cheque by a banker, the total timeline for filing criminal action against the payee remains forty five days (fifteen day notice + thirty day writ). Observe these timelines always with respect to seeking legal redress.

Is a Legal Notice mandatory in a Cheque Bounce case?

Yes, it’s mandatory to send a legal notice when there’s a cheque bounce instance brought under Section 138 of negotiable instruments act. Within one month since he receives a dishonoured check drawee should dispatch an ultimatum requiring money to be delivered in two weeks’ time. The drawee can initiate prosecution if he wishes because it has become mandatory.

What are the Legal Notice charges for Cheque Bounce?

Cost of sending a legal notice in such cases typically vary depending on lawyer fees and administrative expenses. These changes may vary depending on the difficulties and complexity of the cases, the lawyer’s fees and location where the legal notice is being issued is also a main factor which has been seen when evaluating the cost of the legal Notice.

What is the138 Ni Act Procedure?

Section 138 of negotiable instrument act procedure is as follow:

- The Legal Notice is sent to the drawer through Registered post, Email & Whatsapp with all the important information within the next 15 days from the date of cheque bounce.

- The payee/complainant is required to appear in court and present the case’s specifics. If the complainant’s testimony satisfies the magistrate, he will summon the drawer to appear before the court.

- The drawer will show up and either confirm the complainant’s claimed facts. The court will move forward with the criminal trial of the case if the drawer rejects the complaint.

- The drawer/accused will submit his statement, and the court will hear testimony and arguments from both sides.

- If the court rules that the drawer committed the crime of cheque bounce, the court will issue a verdict of conviction against the drawer.

Go through our detailed blogs on Legal Notice for Divorce & Legal Notice For Defamation to know these topic in details.

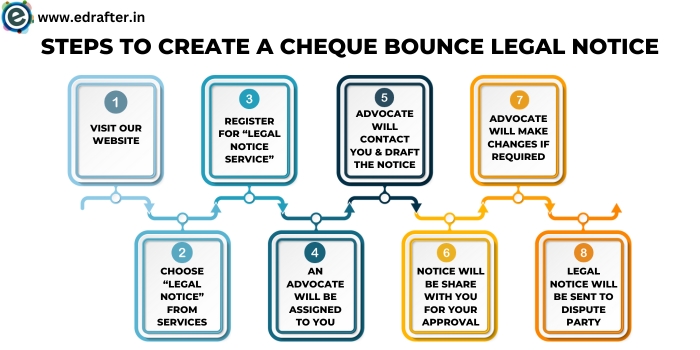

How can you create a Legal Notice for Cheque Bounce?

To draft legal notice under section 138 follow the simple steps below:

- Visit our website www.edrafter.in

- Then click on the ‘Services And choose ‘Legal Notice’.

- After that, register for Legal Notice service.

- Our experienced Advocate will contact you for the details.

- Explain the entire case with all facts and figures which will help our Advocate to draft the Legal Notice in a brief manner.

- The advocate will mail you your Legal Notice draft for your review.

- Get the corrections done if any are needed. We provide unlimited corrections under the draft as Customer’s satisfaction is our top priority.

- After that once all the corrections are done, the Advocate will send the Legal Notice to the dispute party through all possible means and will advice you for further course of action.

What are the important points to be included in the Cheque Bounce Notice?

When Drafting a Legal Notice for the Cheque Bounce cases, it is crucial to include the following points-

- Details of the Parties- The Notice should contain the name and address of both the parties.

- Description of the Cheque- Should clearly specify the cheque details which includes the Cheque number, date, amount, and the back details of the dishonoured cheque

- Consequences for Non-Payment – should Mention the legal Actions that can be taken if the opposite party fails to pay within the stipulated time.

- Contact Details- The Legal Notice should contain the Contact Details of the parties so that they can connect for further communications.

- Delivery Confirmation- for the delivery, a trackable delivery method should be used to ensure the proof of the delivery.

- Legal Counsel- Consider Adding a legal Counsel to understand the implications of non-compliance.

What are the Consequences of Cheque’s Dishonour?

Some of the consequences of Cheque Dishonour are;

- Legal Action- The Opposite Party can start legal proceedings against the issuer if the cheque is dishonoured

- Penalties- issuer can apply penalties or fines for the cheque dishonour.

- Credit Ranking- Negative Ranking in the credits.

- Additional Costs- Incurrence of costs like legal fees and other bank chargers.

- Civil and Criminal Liabilities- Civil or Criminal liabilities for the damages.

- Banking Restrictions- Restrictions from banks on issuing cheques in the future.

Is Section 138 is a bailable Offence?

Yes, Section 138 of NI act is an Bailable offence because the punishment in this offence is imprisonment for two years therefore the offence is bailable and hence anticipatory Bail cannot be granted in these cases.

Legal Notice V/s Demand Notice

| Legal Notice | Demand Notice |

| Legal Notice is a written legal warning from an individual or a company to the other party in order to seek justice through court in case of civil dispute. | A Demand Notice is a written request from the creditor to the debtor for the repayment of the amount owed by the debtor. |

| A Legal Notice is sent in the cases of Civil Disputes. | Demand Notice under section 138 is mainly sent incases of non-payment of the debts. |

| For example, Cheque Bounce, Money Fraud, Divorce cases, Employee/Employer Issue, Owner/Tenant Issue. | For example, Loan |

Also Read, Legal Notice vs Court Notice

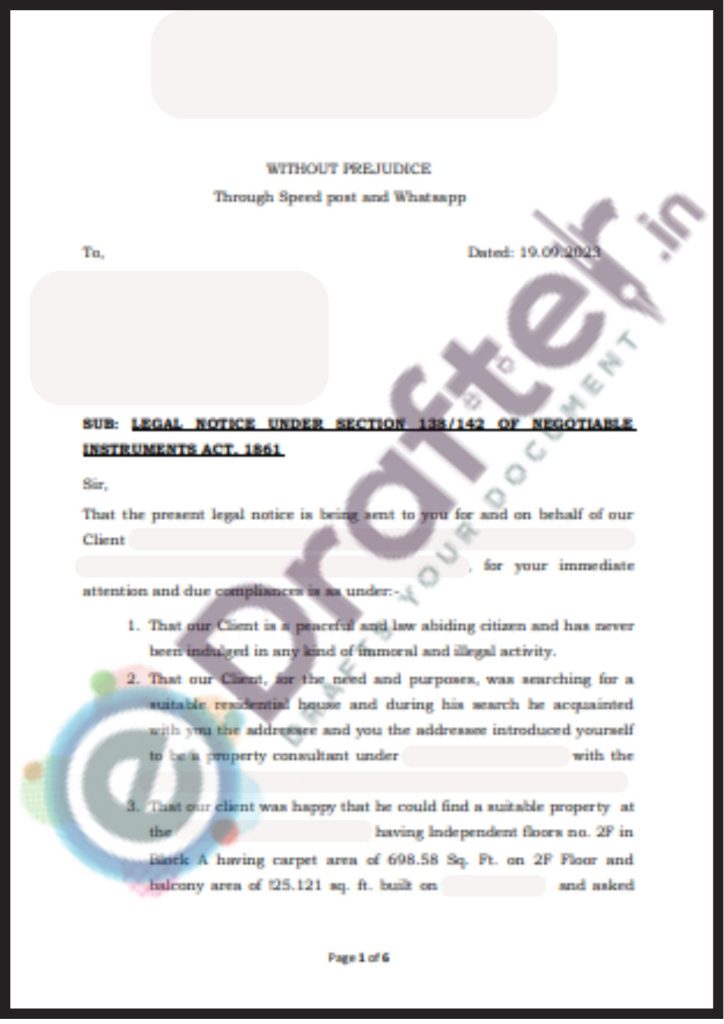

Case Study – Legal Notice Under Section 138/142 of Negotiable Instruments Act, 1861

Dr. Prakash, one of our client, contacted consultant Mr. Biswas to find a residential property for him. They agreed on a price of INR 40,00,000 (Forty lakh), inclusive of GST and Registry charges, with no additional costs. However, after Dr. Prakash received the Agreement of Sale, he was shocked to find an increased amount i.e. INR 50,00,000 (Fifty Lakh). Despite assurances of a refund for the excess payment, when he received two cheques with different dates, the second cheque bounced, and Mr. Biswas became unresponsive. Dr. Prakash sent Legal Notice through our firm, invoking section 138/142 of the Negotiable Instruments Act of 1881, leading to Mr. Biswas being found guilty of an offense punishable by imprisonment for up to two years, and/or a fine double the amount of the cheque and also offenses under the Indian Penal Code, involving fraud and other criminal activities.

After getting our Legal Notice, Mr. Biswas within the time limit of 15 days refunded the entire amount to our client.

Conclusion

Section 138 of the Negotiable Instruments Act serves a crucial role in safeguarding financial transactions by penalizing cheque dishonour due to insufficient funds. It mandates timely settlement through a structured legal process, starting with a notice demanding payment within 30 days of dishonour. Non-compliance within 15 days allows the payee to pursue criminal proceedings, ensuring accountability. Legal notices must be meticulously crafted, specifying parties, cheque details, consequences of non-payment, and contact information. Consequences of dishonour include legal action, penalties, and damage to credit reputation. Section 138 offenses are bailable but require strict adherence to procedural timelines, emphasizing the Act’s role in upholding financial integrity and accountability.