Table Of Content

- Are Consumer Complaints against Insurance Companies helpful?

- Which Type of Complaints can be filed against an Insurance Company?

- How to take Legal Action against an Insurance Company?

- How to file a Consumer Complaint against an Insurance Company?

- How much time does the Consumer Court take?

- Conclusion

Filing a complaint with the Insurance Regulatory Authority of India is necessary for issues concerning claim rejection, delay or malpractice. It encompasses taking up the issue in internal ways which include authority levels like bureaucratic and regulatory agencies as well as courts meant for consumers. By filing a complaint, you ask for a remedy and contribute to improving the conditions within the sphere of Insurance. eDrafter.in can help with such legal documents.

Are Consumer Complaints against Insurance Companies helpful?

Filing a Consumer Complaint against Insurance companies can indeed be well worth the effort, as it will help resolve whatever troubles you have had. A complaint is viewed as a formal contact whereby you get your worries cut across to the appropriate body and/or the Insurance company in question. Here are some detailed reasons why filing a complaint can be beneficial:

- Resolution of Issues: In this sense, a complaint is presenting the Insurance company with a number of the issues that its insurers are grappling with. This may prompt the immediate taking of action on your case and may very convincingly assure you of a fair resolution.

- Consumer Protection: The Consumer Complaints are of very great significance in ensuring that the consumer rights are safeguarded. By using the complaint to state an issue you are not only helping yourself but also enhancing services in the Insurance industry.

- Regulatory Oversight: Regulatory authorities like the Insurance Regulatory and Development Authority of India (IRDAI) take Consumer Complaints seriously. They have procedures that allow them to investigate complaints and ensure that Insurance providers meet regulations and are patient and fair in their dealings with customers.

- Addressing Future Problems: Your complaint can expose any institutional issues that the Insurance company may have which need to be rectified.

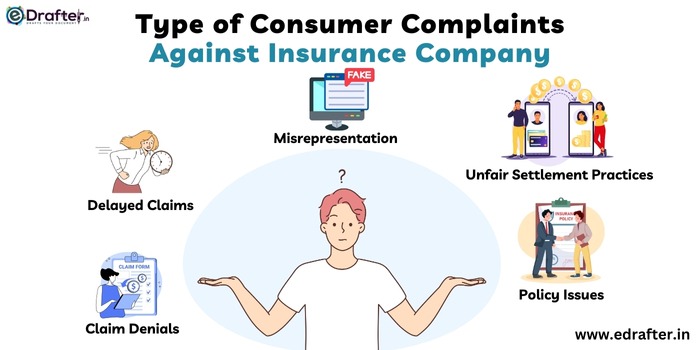

Which Type of Complaints can be filed against an Insurance Company?

You can file different types of complaints against an Insurance company, including:

- Claim Denials: If your Insurance claim has been denied without a valid reason or explanation, you can file a complaint regarding the denial.

- Delayed Claims: Complaints can be filed if the Insurance company is unreasonably delaying the processing or payment of your claim.

- Misrepresentation: If the Insurance company has misrepresented the terms of your policy or provided false information, you can file a complaint based on misrepresentation.

- Unfair Settlement Practices: Complaints can be filed if the Insurance company is engaging in unfair settlement practices, such as offering inadequate settlements or undervaluing claims.

- Policy Issues: Complaints related to policy issuance, renewal, cancellations, or any other policy-related matters can also be filed against an Insurance company.

How to take Legal Action against an Insurance Company?

To Take legal action against an Insurance company follow these steps:

- Know the Policy: The first thing you would do is to read your Insurance policy thoroughly. Identify the terms, coverage, and any other limitations that may be applicable to you. Such information will help you in ascertaining whether or not the Insurance company is being in breach of the contract.

- Attempt to Resolve Disputes Amicably: Before seeking legal measures, concentrate on attempting to address the issue by communicating directly with the Insurance company. Document each communication, whether it’s an email, a letter, or a phone call.

- File a Complaint: Make a complaint, if the issue has not been resolved through direct communication, some complaints can be made in accordance with the Insurance company’s grievance redressal cell or the IRDAI. This step is necessary to facilitate the Insurance company to review the case again.

- Consult with an Attorney: Once the issue is still unresolved and you are still free to see it in your way, an attorney would be the next professional to talk to for help. With great experience in this field, the lawyer will evaluate the facts of your case, answer questions about your legal rights, and explain the relevant legal procedures.

- Gather Evidence: Consider whether you can arrange some proof that will substantiate your case. This includes among other things your Insurance policy, correspondence with the Insurance company, claim documents, etc.

- Initiate Legal Action: If all other avenues have been exhausted, you may need to initiate legal action against the Insurance company. Your attorney can help you draft a legal complaint outlining the details of your case and file it in the appropriate court.

How to file a Consumer Complaint against an Insurance Company?

If one needs to file a complaint in consumer Court against an Insurance company. Then they can do it with the help of various legal service providers. eDrafter.in is one of the most popular legal service providers, through us you can lodge a complaint in the consumer court against an Insurance Company.

- You can visit our website eDrafter.in and can fill up a form regarding your complaint.

- After that our Team will schedule a call for you with our experienced Advocates, you can discuss your issue with them and they will provide you with the relevant resolution.

- If you are satisfied with the resolution provided by our Advocate then you can tell us so that we can proceed further.

How much time does the Consumer Court take?

In India, the duration for the consumer cases is not fixed; it depends upon the complexities of the case, the courts workload and the specific legal procedures. The duration can also depend upon the different Forums of the courts as well as factors like hearings and the time taken for the parties to submit the documents and evidence.

Conclusion

Filing a Consumer Complaint against an Insurance company can be one of the best ways of seeking redress in cases such as claim denials, claim delays, as well as other malpractices within the firms. It provides a safety net to the consumers, the companies as well as the administration and helps resolve conflict. If such informal ways do not help resolve the grievance, then recourse to justice would be required. Internet sites such as eDrafter.in help to ease the filing of complaints, provide legal help. The approximate duration is difficult to anticipate because it depends on the number of complexities of a case and the quantity of works at court rooms.