Company Registration

Get Your Company Registered by the best Documentation Service Provider

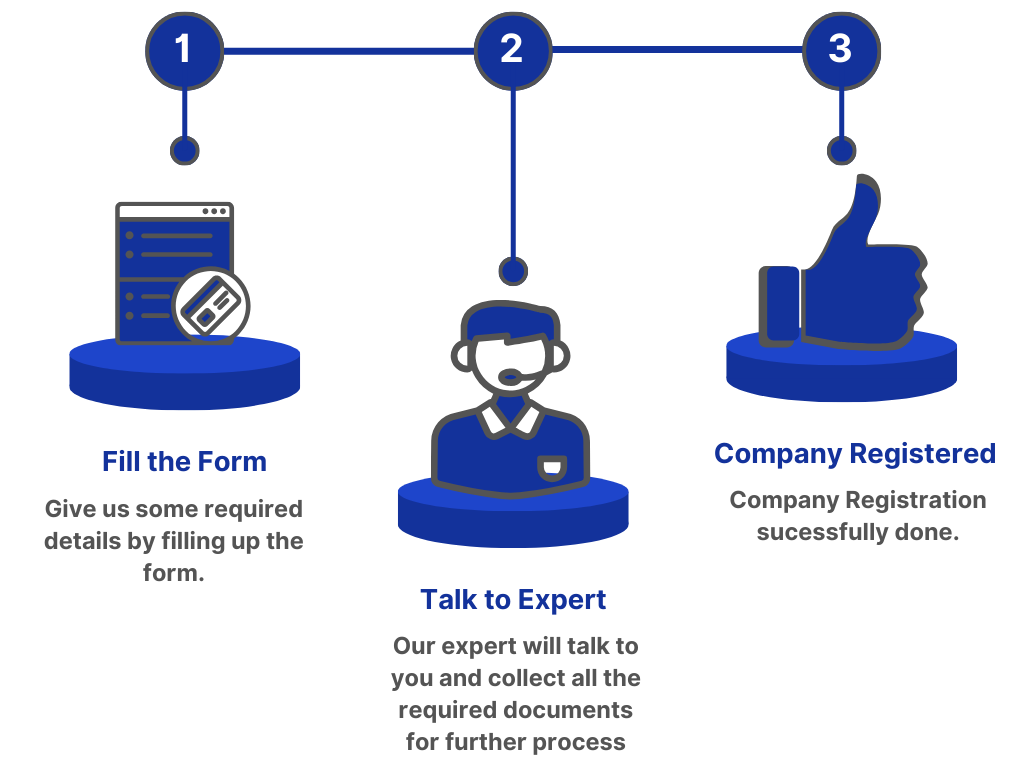

How it Works?

Types of Company Registration

Private Limited Company (Pvt Ltd) Registration

This is the most complete form of incorporation for companies who are looking to scale there businesses in the best way.

Get Started

Limited Liability Partnership (LLP) Registration

LLP is the best kind of registration for partners who want limited liablitilities.

Get Started

One Person Company (OPC) Registration

This is similar to PVT LTD company but there is only one owner/director of the company.

Get Started

Detailed Comparison between types of Companies

| Aspect | PVT LTD | OPC | LLP |

|---|---|---|---|

| Act | The Company Act 2013 | The Company Act 2013 | The LLP Act 2008 |

| Minimum Number of Directors/Partners | At least 2 Directors Required | At least 1 Directors Required | Minimum 2 Partners will be required |

| Maximum Number of Directors/Partners | Maximum 15 Directors a Company Can Have | Maximum 15 Directors a Company Can Have | No Limit |

| Maximum Members/Shareholders | Maximum 200 Members/Shareholders are allowed | Only One | No Limit |

| Authorized Capital | Minimum 1 Lakh | Minimum 1 Lakh | No Minimum Capital Required |

| Eligibility Criteria | Any Person May Form a Private Limited Company, but any of them should be an Indian Resident | A Person who is Resident of India | Any two Person who is Major and at least one of them must be an Indian Resident |

| Put After Name | Pvt Ltd | OCP | LLP |

| Liability of Shareholders/Partners | Shareholder’s Liability is Limited to their Allotted Capital | Liability is Limited to Member’s Capital | Liability of Partners is Limited to their Agreed Contribution |

| Any Changes in Business | Filling Form 32 with ROC | Filling Form INC-4 with ROC | Filling Form 3 with ROC |

| Existence | A Private Limited Company has a Perpetual Succession since any changes will not affect its existence. | A Private Limited Company has a Perpetual Succession since any changes will not affect its existence. | A LLP Company has a Perpetual Succession since any changes will not affect its existence. |

| Transfer of Ownership | Can Transfer Ownership by Transferring Share | Can Transfer Ownership | LLP Ownership is Wholly or Partly Transferable. |

| Business Conversion | Can Be Converted into LLP, OPC or LTD | Can be Converted into LLP or PVT LTD | LLP Can be Converted into Company |

| Maintaining Books of Accounts | Mandatory | Mandatory | Mandatory |

| Maintaining Books of Statutory Records | Mandatory | Mandatory | Mandatory |

| Provision for Public Deposit | Sec. 73 of The Company Act 2013 | Sec. 73 of The Company Act 2013 | No Provision |

| Provision for Loan to Directors | Sec. 185 of The Company Act 2013 | Sec. 185 of The Company Act 2013 | No Provision |

| Board/Partners Meeting | First Meeting should be held within 30 Days from Incorporation, After First Meeting Minimum 4 Meeting in a Calendar year Should be Hold. | NA | Not Required |

| Statutory Audit | Mandatory | Mandatory | In Case Turnover is More than 40 Lakh or Partners Contribution Exceeds 25 Lakh. |

| Internal Audit | Companies Having Turnover of 200 Crore are applicable for Internal Audit | NA | NA |

| Income Tax Audit | Turnover above 1CR | Turnover above 1CR | Turnover above 1CR |

| Income Tax Rate | 25% | 25% | 30% |

| Income Tax Return | ITR-6 | ITR-6 | ITR-5 |