Table Of Content

- Why is a bank locker Agreement important?

- What document do I require for an Agreement for a bank locker?

- How can I get a bank locker agreement online?

- Do I need stamp paper for the locker agreement?

- What are the RBI guidelines for Bank locker agreements?

- Conclusion

From the name itself, we can get an idea about this Agreement. So a Bank locker Agreement Is an agreement which is signed between the bank and the Customer holding a bank account in that particular bank. This Agreement is also called the ‘Safe Deposit Locker Agreement’. If the Customer wants to avail of this Bank Locker Service then they are required to directly get in touch with the bank. If the bank has agreed to the Agreement for the bank locker then it can be initiated on the spot. We will be discussing all about the Safe Locker agreement and how you can procure it through our website easily, keep scrolling:

Why is a Bank Locker Agreement important?

Individuals with something very valuable which no one should be aware off mainly take the service of Bank Locker. A valuable asset that they are scared of getting stolen even from their homes. Banks are institutions where people can blindly trust with their cash and valuable assets. Their core job is to keep it safe from theft and fire etc. As you all know the agreement is made between the Customer and the Bank. The customer can be two more individuals sharing one Bank locker, a proprietorship firm, a partnership firm, a Hindu Undivided Family, etc. They all have the right to create a Bank Locker Agreement online or offline. It depends on them.

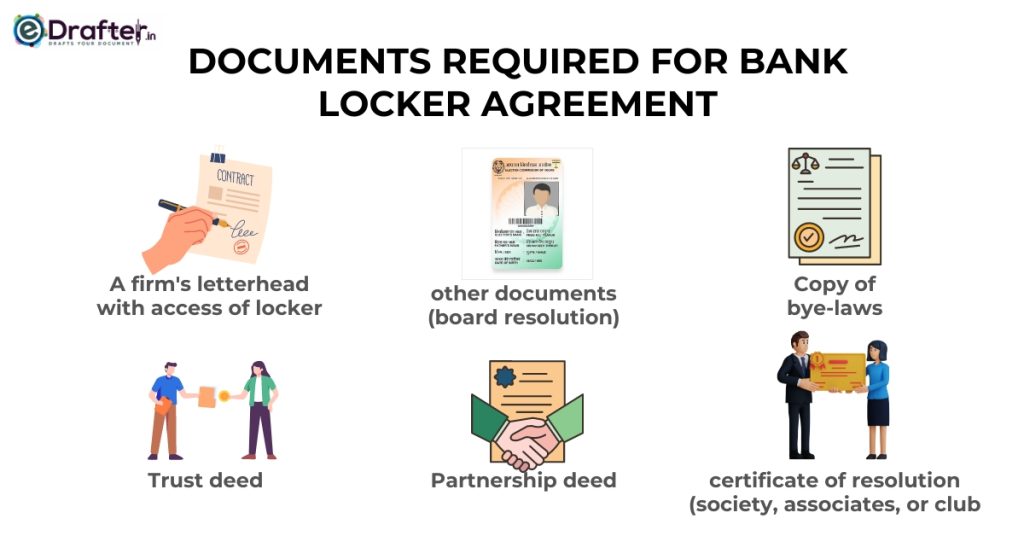

What Document do I Require For an Agreement For a Bank Locker?

The documents that you would be needing for opening a Bank locker Account.

- A letter on the firm’s letterhead mentioning the people authorized to access the locker

- Mode of operation,

- Along with other documents like a board resolution,

- Copy of bye-laws,

- Trust deed,

- Partnership deed,

- A certificate of resolution from a society, associates, or club, and other documents, will be required.

How can I get a Bank Locker Agreement Online?

By both modes—online and offline—Indian bank locker agreements can be drafted. Offline Agreements can be prepared with the help of a lawyer or Advocate. As for the Online Bank Locker Agreement, you can get it prepared through our ‘Custom Drafting Service’. The Steps to create an Agreement for Bank Locker are as follows:

- Step 1: Go to the edrafter.in and click on the “Request for Custom Documents” on the homepage.

- Step 2: Then redirected to the ‘Custom Drafting Page’.

- Step 3: Fill out the form with all the necessary details such as student name, email address, phone number, and your requirements.

- Step 4: Review the details to make sure it accurately reflects your requirements.

- Step 5: Once you are satisfied with the details, click on the “Proceed to Payment” button to pay for the service.

- Step 6: After completing payment, you will receive a draft of your Agreement in your mail for your approval and it will be processed once you have approved.

Ensure that your documents are simple, clear, and compliant with the law.

Do I need Stamp Paper For the Locker Agreement?

Paying appropriate Stamp Duty to the government is mandatory under the jurisdiction of the Indian Stamp Act, of 1899. The Stamp Duty required for the Agreement depends on the State and would be applicable according to the concerned State. The Bank bears the responsibility for the cost of the Bank locker agreement stamp paper and supplementary Agreement whereas for the other charges, they are borne by the Customers. For example, If in Maharashtra Bank locker agreement stamp paper value will be 100/- or 500/-.

What are the RBI guidelines for Bank Locker Agreements?

The new locker agreement RBI guidelines by RBI, the last date of revising the Indian bank locker agreement was 31st June this year, are as follows:

- Customers may only store authorized things in the locker in accordance with the new regulations. It expressly prohibits keeping any illicit materials, such as dangerous materials, etc. The new regulations allow the bank the authority to take “appropriate action” against the consumer if there is any suspicion.

- Additionally, it can’t escape liability for any loss or damage to the contents of the lockers, including fire, theft, burglary, dacoity, building collapse, etc. RBI will also be liable to the client in these cases. If an employee commits fraud and causes damage, the bank is also responsible.

- The bank’s obligation in content loss instances will be “equivalent to one hundred times the prevailing annual rent of the safe deposit locker,” according to the new regulations. However, in the event of floods, earthquakes, or other natural disasters, the bank will not be responsible for any loss or damage to the contents of the lockers.

- The bank may break into a locker “following due procedure” after notifying the customer and granting them access to remove their belongings if the locker rent is not paid within three years.

According to the RBI, bank locker rules 2023, before the deadline in December, each person must update their locker agreement with the bank.

Conclusion

A bank locker agreement is signed by the customer who has an account with the concerned bank. It is far more practical to create a bank locker agreement rather than use the offline method. You can get your bank locker agreement online easily and hassle-free without going anywhere through Our website.