Ques – Why do we make a Rental Agreement for 11 months?

Rental Agreement for 11 months made to avoid the Strict Rental Law which applies for the Lease up to 12 months, that is why also the One Month in the count of 12 months consider as the month of Notice Period Serving by the Owner.

Ques – What Stamp Paper should we use – Stamp Paper OR e-Stamp Paper?

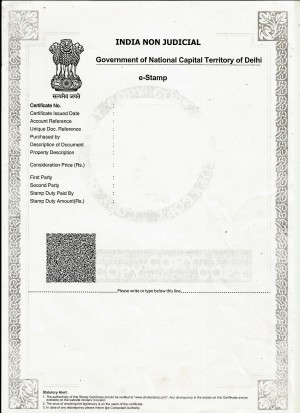

Now, there is no Stamp Paper system left in Delhi. The Prevailing system of Stamp paper had been replaced by the Government in the year 2011. The government has appointed Stock Holding Corporation India Limited as their Central Record Keeping Agency and they are the Only CRA with Government for e-stamping. So, the Rental Agreement should made only on e-stamp paper, it is far safe as compared to the prevailing system.

Image of e-Stamp Paper:

Ques – What is the prescribed Stamp Duty for Rent Agreement?

The prescribed Stamp Duty for Rent Agreement in Delhi is Rs. 50/-, though after introducing e-stamp paper no fixed denomination left. You can make Rent Agreement on e-Stamp Paper of any amount, still it is always recommended to make Rent Agreement on a Stamp paper of Rs. 50/- or on higher value to avoid any misshapen in terms of Legal Crises Later.

Ques – What if we will not pay the prescribed Stamp Duty to the Government?

It is always recommended to pay the prescribed Stamp Duty to avoid any Legal Crises. For each article, there’s different stamp duty set by the Government which varies from State to State. For example- in Delhi the Stamp Duty for Rent Agreement is Rs. 50/- while in Bangalore the Stamp Duty for Rent Agreement is Rs. 20/-.

For example – if you have made the Rent Agreement on Rs. 10/- e-Stamp paper and you approach the Court due to any Legal Crises to arise then Court can Charge the fine up to 10 times the stamp duty amount to be paid.

So, it’s always recommended to make the Rent Agreement on e-Stamp paper of Rs. 50/-.

Rs. 50 is the prescribed Stamp Duty for the Delhi State and commonly used as well.

Ques – How to Print Rental Agreement on e-Stamp Paper?

Start printing the Rent Agreement below the line on the e-stamp paper and mention Continued to page 2 and attach other pages of Rent Agreement giving the Page Numbers. While giving the Page Number consider the Stamp Paper Page as Page Number 1 and mark other numbers of the page accordingly.

Ques – Is mandatory to include the Details of all the Tenants while drafting the Rent Agreement?

Yes, it’s highly recommendable to include the Details of all the Mature Tenants. If you will not include the details of all the Tenants then the terms and conditions mentioned in the Agreement will not be applicable to all the Tenants which can cause problems in the future.

Ques – Which One is more Secure, the Notarized Rent Agreement OR the Registered Rental Agreement?

Registered Rent Agreement is more secure, however, the case depends on these two points-

- If the Agreement made for 11 months then notarizing it with Notary Public is sufficient and Valid.

- If the Agreement made for above 11 months then it is making it register as the validity for Notary Attestation is for 1 year in case of Rent Agreement.

Ques – What Consequences can face if we will not make our Rental Agreement Registered?

If the Concerned Rent Agreement has for more than 11 months then the unregistered rent agreement cannot use as evidence in Court. It cannot be used as a proof or claim of any terms and conditions provided. So, it is always recommended to make the Rent Agreement registered to be on the safer side to avoid any kind of loss.

Ques – Which one Includes Less Cost – Notarized Rental Agreement Or Registered?

Notarized Rent Agreement includes less cost. You can get a Notarized Rent Agreement within Rs. 200 – Rs. 400/-, about Registered Agreement it cost more as compared to the Notarized Rent Agreement as per the Rent the Stamp Duty needs to be pay. It can cost around – Rs. 3,000 to Rs. 6,000/- or it depends upon the Rent of the Property.

Ques – What are the different Charges included to Register the Rental Agreement?

- If the Lease is up to 5 years then the Stamp Duty cost is 2% of the total annual rent and if there is also security deposited then additional Rs. 100/-.

- If the Lease is from 5-9 years then the Stamp Duty cost is 3% of the total annual rent and if there is also security deposited then additional Rs. 100/-.

- If the Lease is of above 9 years then the Stamp Duty cost is double of 3% i.e 6% of the total annual rent and if there is also security deposited then additional Rs. 100/-.

Minimum Registration Fees of Sub-Registrar is Rs. 1,100/- (Rs. 1,000/- and additional pasting fees of Rs. 100/-) also needs to pay.

Ques – What are the Documents required for Registration?

Documents required for the registration process:-

- One Original Identity Proof of Owner and Tenant.

- Two Passport Size Photographs of each Owner and Tenant.

- Two Witnesses with their Original Identity Proof.

Ques – How much time Registration process take?

It depends upon the Appointment as well as on the Status of the Application. Usually, the Registration process takes 2-4 Working Days.

Create Rent Agreement Online With eDrafrer Now

We provide the fully drafted rental agreement including all the important terms and conditions. We provide service at the doorstep in which simply what you have to do Provide us your details by filling up the form(designed securely to capture your data), place the order and we will quickly draft your Rental Agreement along with the prescribed e-stamp paper, Make it Notarized and deliver it to you.