Table Of Content

- What does a Will mean in India?

- How many Types of Will are there in India?

- Why should you have a Will?

- What is the Importance of a Will?

- What are the Essential Elements of a Valid Will in India?

- What is the Validity of Will after the Death of the Testator?

- Who can and cannot Prepare a Will in India?

- Does a Will need to be Prepared on Stamp Paper?

- How to Prepare a Valid Will with eDrafter?

- Frequently Asked Questions

A Will known as ‘Vasiyat’ whereas according to Muslim Law it is referred as ‘Wasiyat’. Writing a Will represents the distribution of the assets and properties of a person. In a year 1925, a rule was formed called as – Indian Succession Act 1925 wherein the WILL got introduced, all religions can make their Will according to this Act except for Muslims as they need to follow Muslim Law to make their WILL.

Indian Succession Act enacted by the Parliament in the seventh year of Republic of India and it is applicable for entire India except Jammu & Kashmir.

What does a Will mean in India?

The name “WILL” itself refers to a person’s desire to leave their possessions, such as property and assets, to their loved ones after they pass away. By declaring this real on paper, the government gave its people to make their own Will. When a person meets the requirements to write their own legal will and is physically capable, they are able to draft a will. Even if most of them are ignored because people are not interested in law and order, they are typically informed of their powers. People should be aware of a number of devices, including wills, which are in fact highly privileged in India.

How many Types of Will are there in India?

In India, majorly there are 2 types of will which we have outlinned below.

- Privileged Will

- Unprivileged Will

Although, there are few other types of Will are there that you can read in our detailed blog on Types of Will.

Why should you have a Will?

There are end number reasons that you should be drafting a Will. The reasons are as follows:

- Avoids disputes among families: As already discussed above about the family Will. That a legal Will represents the distribution of assets and properties of a person. A Will gives the person the power to distribute his assets and properties to anyone whoever he/she wants without any boundations. A legal Will is labelled as a ‘secret document’ because the contents in it are kept confidential. Only the Testator and Executor are the parties who know the contents of the property Will. Else it is treated as invisible till the time it comes into power or any changes that need to be made. So if the Will is in more favour of one party and less on the second party like this the dispute is avoided since no one knows the inside content of the legal Will.

- Support a social cause: Out of a Goodwill you have an option of giving your whole property in charity. There are many cases such as your family isn’t much supporting and being unsupported, then in such cases you can give out your property in charity or orphanages to help the needy people. So while writing a Will you can always share a certain percent of your property in charitable organisations.

- Live Stress Free: When you know that after drafting a Will. Few things are clear that your children will be secured even if some mishap occurs and you will no longer accompany them. The legal Will after death of your will help them through which they don’t have to struggle for long since your WILL be a backup for them and throw some light on how things are to be done without your presence. You will be at ease after making the Will knowing that your family and children do not have to struggle much.

What is the Importance of a Will?

A legal Will has the power to resolve disputes which usually occurs in any family matters. A Will lawyer means a testator involves many vital equations regarding the division of property and assets while drafting the Will.

Let’s talk about the Famous 18 years battle between Birla family and the Lodha’s :

Priyamvada Devi Birla wife of MP Birla (Birla Group) died in 2004 while leaving behind her WILL claimed that she bequeath 5000 crore estate to her Chartered Accountant R.S Lodha. The legal Will was claimed to be prepared in the year of 1999 and gave the complete control of Birla Group to R.S Lodha. As per Birla Family M.P Birla and Priyamvada Birla had a mutual WILL dated July 1993 according to which major estate would be transferred to three trusts.

On April 21, 2021 the Calcutta High Court gave their verdict that HV Lodha son of RS Lodha to continue his chairmanship in MP Birla’s Company whereas in March 31, 2022 the Supreme Court gave their verdict on this stating that it’s a win win situation for both parties as Birlas can drive the benefits by early conclusive disposal of pending appeals and Lodha would be able to take in the benefit of continuing the chairmanship of the Birla Group.

Now you can see how much importance a WILL has. No one thought such astonishing outcomes could come before eyes. Who would have thought that such a huge estate would go to an outsider; WILL is a strong Document that even an Indian Law cannot neglect. That’s why we always suggest preparing a WILL.

What are the Essential Elements of a Valid Will in India?

The essential elements of a valid will in India are as follows:

The Testator Details

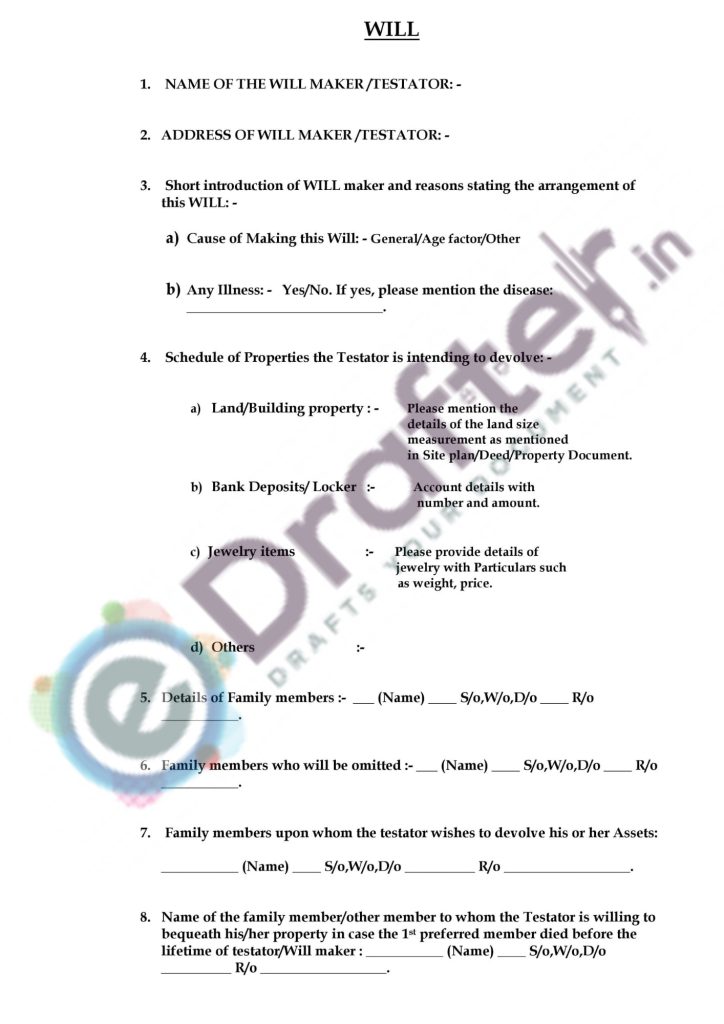

Testator means the person who is drafting the WILL. Testator should mention the details as below:

- Name as per the Official Records

- Age

- Name of the Father/Mother

- Religion

- Occupation

- Nationality

- Reason behind making the WILL i.e. either General Factor, Age Factor or any other reason.

- Illness : It is advisable to mention the illness as well (if any).

The Property and Assets Details

The Testator should mention the Immovable and Movable asset details which he/she wishes to bequeath in favour of the beneficiary.

- Under Property details the Address and the Measurement should be mentioned as per the Site Plan/Property Document/Deed.

- Under Bank Deposit/Locker the Account details along with the Account Number, Total Amount and with other relevant details should be mentioned.

- Under Jewellery Items the details of Jewellery along with the Weight & Current Market Price should be mentioned.

- You can also include other Items like PF, Mutual Funds, Shares and other savings.

Note: The Immovable assets are those assets which cannot be moved like the Land and buildings whereas the Movable assets counts the personal belongings such as the Jewellery and liquid cash which can be moved by the individual.

Executor Details

An executor is a legal representative of the Testator which carries out all the Legal formalities in respect of the WILL after the death of the Testator, Executor is responsible for the Probation of the WILL, the Executor is a most trusted person and does not have any desire in the Testator’s legal Will. The Testator details should be mentioned as per the below format:

- Name (as per Official Records)

- Father/Husband’s Name

- Age

- Address as per Aadhaar Card

Sample Format : _____________ (Name) _______________ S/o,W/o,D/o __________________ R/o ___________________________________.

Beneficiary Details

Beneficiary is the person on whose favour the assets get bequeathed. The WILL came into effect after the death of the Testator before that only the Testator and Executor are the only people who know the contents of the WILL. The Beneficiary details should be mentioned as per the below format:

- Details of all the family members.

- Family members who will be omitted from the WILL.

- Family member on whom the Testator wants to dissolve the Assets.

- Family member to whom the Testator will bequeath the Assets if the 1st preferred member dies before the Testator.

Sample Format for all above details : _____________ (Name) _______________ S/o,W/o,D/o __________________ R/o ___________________________________

Briefing

Here the Testator mentions the details about his Assets and property collectively along with the details of the Executor and beneficiary. The Testator reasons why he/she is writing a WILL.The Testator mentions the content as per the given format:

- At the Header of the Will it is compulsory to mention ‘This is the Last Will And Testament’.

- After that a line is written such as “that the Life is uncertain” then the Testator gives the reason why he/she wants to make the WILL. Then starts to distribute his property & assets accordingly among his beneficiaries.

- At the end mentioning the Witnesses details the Day and Date when WILL is made. Having a Witness is important so that the Testator has a back up who can object if anything does not go according to the Testator’s wish after his death.

- Signatures of the testator & Witnesses: At Last without the Signatures WILL cannot be labelled as ‘Invalid’. The signatures of the Testator is important because he/she is one who made the WILL. Then comes the Witnesses details and Signature which is as follow:

- Name of the Witness (as per the Official Record)

- Father/Husband’s name

- Address as per Aadhaar Card

What is the Validity of Will after the Death of the Testator?

The validity of WILL depends whether it has been registered or not, unregistered WILL is not considered to be valid; there is no point to discuss whether the validity of WILL after death of Testator as the nature of this Article is to come into effect once the testator gets died. Before that WILL would be just considered as a “Secret Document” however once the testator gets dead the WILL shall come into an action wherein the beneficiary shall become the owner of the assigned assets.

What if the Beneficiary Dies and the Testator is Alive?

In this case the Testator needs to prepare a Codicil (it is an addendum for WILL under which if the testator wants to add/remove any point or any person that a Codicil needs to be prepared) and shall bequeath his/her assets to another beneficiary.

What if Beneficiary and Testator both Died?

In that case all the Legal Heirs shall dissolve their rights to one of the Legal Heir while proceeding legally for the Succession Certificate and accordingly the property shall be transferred to the concerned Legal Heir.

What happens if the Executor Dies before the Testator?

If such a case comes up then the Testator will need to prepare a Codicil and then he will assign a new executor in the WILL.

Who can and cannot Prepare a Will in India?

Every individual above the Age of 18+ can prepare a Will. It’s a myth that the property WILL can be prepared only at an Older age; Age is just a number when we talk about Will. If the Testator is physically and mentally fit then they are eligible to make a WILL while on the other hand if the Testator is suffering from a serious illness such as paralytic situation, bedridden or is a Minor then they are unfit to prepare a WILL.

Does a Will need to be Prepared on Stamp Paper?

Will needs to be prepared on a Plain paper only. No Stamp Duty is required to be paid in this however it is mandatory to get it registered and to pay appropriate Registration fees; But if there is a property that is mentioned in the WILL and lies outside the India then it has to be prepared on a Stamp Paper while paying appropriate Stamp Duty to Indian Government.

How to Prepare a Valid Will with eDrafter?

We provide two services regarding the WILL.

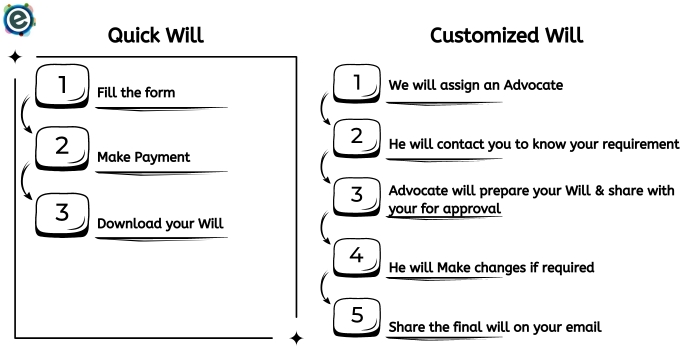

- Quick Will : Creating any sort of Legal Document at our portal is so easy that without any Legal knowledge anyone can create the Legal Documents, with the help of our Live Editor you can create valid WILL within just 10 minutes. Just Fill the Form, Make the Payment & Download your WILL (prepared by Legal Experts).

- Customized Will : We have also introduced another service related to WILL wherein our advocate will be appointed to you to get your customised WILL prepared. Here you can coordinate with our advocate regarding the WILL and tell him how you want it to be prepared. The equations that need to be mentioned in detail. And our Advocate will prepare it for you and share it on your Registered Mail.

Frequently Asked Questions

Cost of making WILL is quite a bit of money, depending on who you ask. While it differs from State to State. Depending on the needs of the Testator, the cost of making a will in an Online process. In reality, the cost of drafting a will covers both the Will’s preparation and registration fees. For instance, registration fees in Delhi are 600; otherwise, they differ from State to State.

In India, a valid Will needs to be registered. The testator’s Adhaar card and the Adhaar cards of the witnesses who are specified in the will are required documents for the registration of a will. The testator and the witnesses should also be present, along with the Parties.

To confirm whether the property and assets belong to the testator or not, you must also present the property paperwork. The deed writer or attorney who is preparing your property Will must be shown. Whereas when you go to register the Will, the registrar’s request to see the Will must be complied with

It is mandatory to register a Will. It is considered as invalid since registering it gives it a boost and authenticity to the document. Through which nowhere it can be rejected.

No, since the executor is the person who takes forward the Will procedure after the death of the Testator and who does not show any kind of desire towards the Will.